What Is a Forex Currency Trader?

Contents

So instead of depositing AUD$100,000, you’d only need to deposit AUD$1000. A country’s credit rating is an independent assessment of its likelihood of repaying its debts. A country with a high credit rating is seen as a safer area for investment than one with a low credit rating. Connect with master’s programs around the country to get an edge over the competition. To the best of our knowledge, all content is accurate as of the date posted, though offers contained herein may no longer be available.

Nevertheless, the effectiveness of central bank “stabilizing speculation” is doubtful because central banks do not go bankrupt if they make large losses as other traders would. There is also no convincing evidence that they actually make a profit from trading. The foreign exchange market is a global decentralized or over-the-counter market for the trading of currencies. It includes all aspects of buying, selling and exchanging currencies at current or determined prices. In terms of trading volume, it is by far the largest market in the world, followed by the credit market.

Why is day trading so hard?

Volatility – At times, the financial market can be extremely volatile, which makes it extremely hard to operate. Impatience – At times, traders are increasingly impatient when starting their careers. They want to start today and succeed tomorrow. Well, patience its one of the key to succeed as a trader.

Independent foreign exchange traders make money whenever they make a sale that results in a profit. It is a career that can come with a considerable amount of risk, and you must be able to bullish and bearish flags recognize and mitigate risk whenever possible. There is almost no barrier to entry to becoming a forex trader, trading stocks, trading binary options or any other type of financial market.

Advanced execution management

Currency markets change frequently, giving you many opportunities to keep learning. Even after you gain live trading experience, you might want to continue practicing with a demo account, especially when testing new strategies. While the average investor probably shouldn’t dabble in the forex market, what happens there does affect all of us. The real-time activity in the spot market will impact the amount we pay for exports along with how much it costs to travel abroad.

Not just for currencies – show data and manage orders on any instrument using the FXTrader trading cells. If you are an institution, click below to learn more about our offerings for RIAs, Hedge Funds, Compliance Officers and more. Some of the most popular widgets include Live Rates Feed, Live Commodities Quotes, Live Indices Quotes, and Market Update widgets. All these platforms can be used to open, close and manage trades from the device of your choice. The chart displays the high-to-low range with a vertical line and opening and closing prices.

The number of foreign banks operating within the boundaries of London increased from 3 in 1860, to 71 in 1913. At the start of the 20th century, trades in currencies was most active in Paris, New York City and Berlin; Britain remained largely uninvolved until 1914. Between 1919 and 1922, the number of foreign exchange brokers in London increased to 17; and in 1924, there were 40 firms operating for the purposes of exchange.

Factor in a diverse array of products, and retail traders enjoy a high degree of strategic freedom. All forex trades involve two currencies because 24option you’re betting on the value of a currency against another. EUR, the first currency in the pair, is the base, and USD, the second, is the counter.

Is there an app to practice day trading?

The Robinhood investing app keeps day trading as simple as possible. There is no account minimum required to start investing and you can trade stocks, ETFs, options and even cryptocurrency with no trading or commission fees.

By far, the most common attribute among successful traders is that they have a plan. The trading plan is a structured approach to trade selection, trade management and risk management. Without a plan, a trader is likely to flounder in live market conditions. If your goal is to become a consistently profitable forex trader, then your education will never stop.

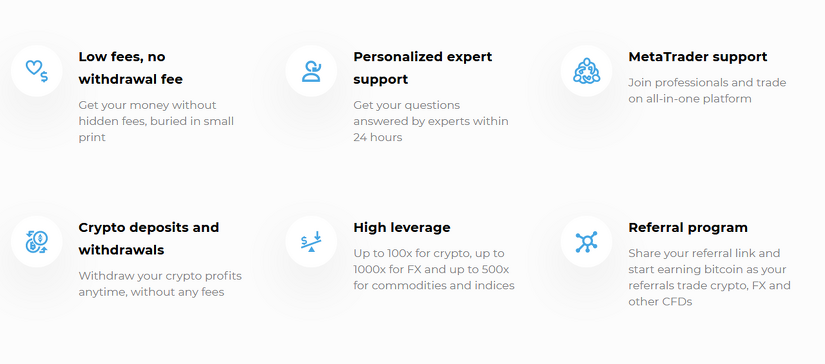

How to start trading forex

Get tight spreads, no hidden fees, access to 12,000 instruments and more. Always changing your trading style can lead to trouble and is a sure-fire way to blowing your account. Our gain and loss percentage calculator quickly tells you the percentage of your account balance that you have won or lost. Our trade matching will enable you to access firm pricing, achieve high certainty of execution and trade efficiently. By submitting your details, you are agreeing to receive communications about Refinitiv resources, events, products, or services. CFA Institute allows its members the ability to self-determine and self-report professional learning credits earned from external sources.

All exchange rates are susceptible to political instability and anticipations about the new ruling party. Political upheaval and instability can have a negative impact on a nation’s economy. For example, destabilization of coalition governments in Pakistan and Thailand can negatively affect the value of their currencies. Similarly, in a country experiencing financial difficulties, the rise of a political faction that is perceived to be fiscally responsible can have the opposite effect. Also, events in one country in a region may spur positive/negative interest in a neighboring country and, in the process, affect its currency. The mere expectation or rumor of a central bank foreign exchange intervention might be enough to stabilize the currency.

IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Please ensure you understand how this product works and whether you can afford to take the high risk of losing money. If the EUR/USD exchange rate is 1.2, that means €1 will buy $1.20 (or, put another way, it will cost $1.20 to buy €1). Whether you’re choosing to trade on a regulated exchange or in the off-market exchange, beware of any scheme that says you can get rich quickly. Forex traders can lose more than the value of their initial investment if they are not careful.

Working for a company usually requires more rigid standards of formal education and training. Trading forex involves the buying of one currency and simultaneous selling of another. In forex, traders attempt to profit by buying and selling currencies by actively speculating on the direction currencies are likely to take in the future.

Forex for Hedging

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

They are visually more appealing and easier to read than the chart types described above. The upper portion of a candle is used for the opening price and highest price point used by a currency, and the lower portion of a candle is used to indicate the closing price and lowest price point. A down candle represents a period of declining prices and is shaded red or black, while an up candle is a period of increasing prices and is shaded green or white. In a position trade, the trader holds the currency for a long period of time, lasting for as long as months or even years. This type of trade requires more fundamental analysis skills because it provides a reasoned basis for the trade. In the forwards market, contracts are bought and sold OTC between two parties, who determine the terms of the agreement between themselves.

Economic data is integral to the price movements of currencies for two reasons – it gives an indication of how an economy is performing, and it offers insight into what its central bank might do next. Each currency in the pair is listed as a three-letter code, which tends to be formed of two letters that stand for the region, and one standing for the currency itself. For example, GBP/USD is a currency pair that involves buying the Great British pound and selling the US dollar. The U.S. dollar is involved in just about every major currency pair, because it is the reserve currency of the world. Currencies on the forex are represented by three-letter abbreviations, such as USD for the U.S. dollar, EUR for the euro, and JPY for the Japanese yen.

These firms need specialized teams of traders to do the research and carry out the trades. Risk aversion is a kind of trading behavior exhibited by the foreign exchange market when a potentially adverse event happens that may affect market conditions. This behavior is caused when risk averse traders liquidate their positions in risky assets and shift the funds to less risky assets due to uncertainty. Fluctuations in exchange rates are usually caused by actual monetary flows as well as by expectations of changes in monetary flows. These are caused by changes in gross domestic product growth, inflation , interest rates , budget and trade deficits or surpluses, large cross-border M&A deals and other macroeconomic conditions. Major news is released publicly, often on scheduled dates, so many people have access to the same news at the same time.

You can edit the quotes by typing three letters separated by a period. Reserve funds, wire transfers, local cheques and bank drafts are some of the convenient options available. You can always find an FX Trader cambio with the cash and currency you need to meet your exchange needs. Improve your relationship with your suppliers with our foreign currency conversion and payment solutions.

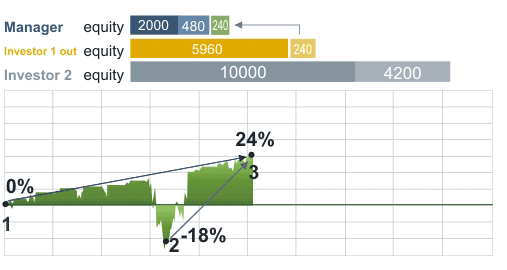

What is Leverage in Forex?

You can also trade the way you want, when you want because FX Trading brings together a number of our trading venues. With spot, forwards, swaps, NDFs, options, precious metals, and money markets, you canexecute all of your trades through one single solution. Please note that when a quote is inverted, it will not affect the default method of trading in the contract. To return to the spot quote for the currency pair, simply click on the arrows. IBKR’s FXTrader combines quotes from 17 of the world’s largest interbank dealers and offers TWS users a dedicated and highly configurable forex trading resource. There are a variety of vendors that exchange currencies, and each currency trader has the opportunity to shop around for the best deal.

The FX options market is the deepest, largest and most liquid market for options of any kind in the world. The most common type of forward transaction is the foreign exchange swap. In a swap, two parties exchange currencies for a certain length of time and agree to reverse the transaction at a later date. These are not standardized contracts and are not traded through an exchange. A deposit is often required in order to hold the position open until the transaction is completed.

Hearst Newspapers participates in various affiliate marketing programs, which means we may get paid commissions on editorially chosen products purchased through our links to retailer sites. Our free Let’s Get to Know Forex guide will cover how to get started, help you make your first trades and outline how to create a long-term trading plan for long-term success. Therefore each trade is counted twice, once under the sold currency ($) and once under the bought currency (€).

The most commonly traded are derived from minor currency pairs and can be less liquid than major currency pairs. Examples of the most commonly traded crosses include EURGBP, EURCHF, and EURJPY. On the forex market, trades in currencies are often worth millions, so small bid-ask price differences (i.e. several pips) can soon add up to a significant profit.

A Day in the Life of a Foreign Exchange Trader

Despite the enormous size of the forex market, there is very little regulation because there is no governing body to police it 24/7. Instead, there are several national trading bodies around the world who supervise domestic forex trading, as well as other markets, to ensure that all forex providers adhere to certain standards. For example, in Australia the regulatory body is the Australian Securities evening star doji and Investments Commission . Leverage is the means of gaining exposure to large amounts of currency without having to pay the full value of your trade upfront. When you close a leveraged position, your profit or loss is based on the full size of the trade. Unless there is a parallel increase in supply for the currency, the disparity between supply and demand will cause its price to increase.

Foreign exchange trading is also known as FX trading or forex trading. It provides the opportunity to speculate on price fluctuations within the FX market. The goal of FX trading is to forecast if one currency’s value will strengthen or weaken relative to another currency. A forex trader will encounter several trading opportunities each day, due to daily news releases. Currency carry trade refers to the act of borrowing one currency that has a low interest rate in order to purchase another with a higher interest rate.

The foreign exchange market is considered more opaque than other financial markets. Currencies are traded in OTC markets, where disclosures are not mandatory. Large liquidity pools from institutional firms are a prevalent feature of the market.

Find the best foreign exchange rates

You can lose all of your capital – leveraged forex trading means that both profits and losses are based on the full value of the position. A nation’s debt can be a large influencer in the variations of its currency price. Countries with large debts in relation to their gross domestic product will be less attractive to foreign investors.

Swing trades can be useful during major announcements by governments or times of economic tumult. Since they have a longer time horizon, swing trades do not require constant monitoring of the markets throughout the day. In addition to technical analysis, swing traders should be able to gauge economic and political developments and their impact on currency movement. A scalp trade consists of positions held for seconds or minutes at most, and the profit amounts are restricted in terms of the number of pips.

Ten-year veterans either head up trading floors and manage other traders or are major producers with significant responsibilities in their firms. Some are in-house consultants for major international firms while others have become independent traders, capitalizing on past success. Many who do not go independent only spend another five years in the profession before retiring or finding another position; the pace and pressure eventually exhaust even the most passionate of traders.